38 present value of coupon bond

How to calculate the present value of a bond - AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor. Value and Yield of a Zero-Coupon Bond | Formula & Example The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ...

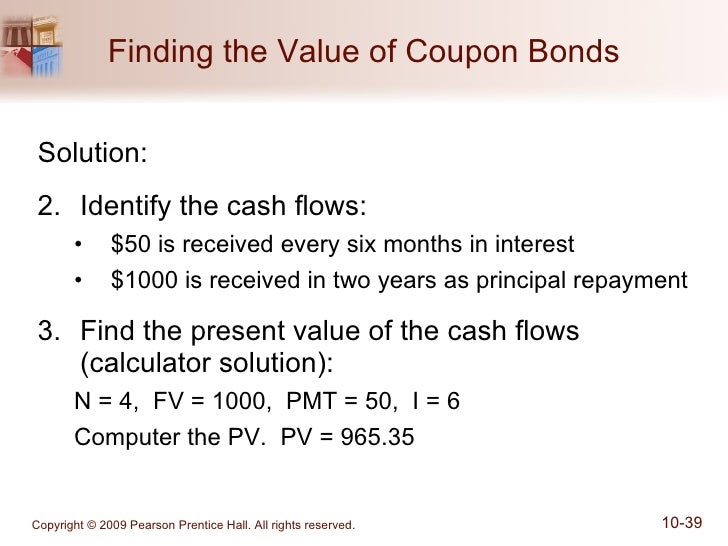

Bond Formula | How to Calculate a Bond | Examples with ... The term "bond formula" refers to the bond price determination technique that involves computation of present value (PV) of all probable future cash flows, such as coupon payments and par or face value at maturity. The PV is calculated by discounting the cash flow using yield to maturity (YTM). Mathematically, the formula for coupon bond is represented as,

Present value of coupon bond

How to Calculate Present Value of a Bond - Pediaa.Com Sep 02, 2014 · A bond is a financial debt instrument. Calculating present value of a bond involves discounting coupon income based on the market interest rate plus discounting the face value of the bond after the maturity period. This value represents the current value of the future cash flows that will be generated by this instrument. Save How to Calculate the Price of a Bond With Semiannual ... Concluding the example, adding the present values of each payment results in a total present value of $964.91. This means the bond's price needs to be $964.91 to achieve an equivalent return. If you can get a lower price, you'll enjoy a higher return, but if you have to pay a higher price, you're better off opting for the alternative investment. Zero Coupon Bond Calculator - What is the Market Value? Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000. Interest Rate: 10%. Time to Maturity: 10 Years, 0 Months. Substituting into the formula: P ( 1 + r) t = 1 0 0 0 ( 1 +.

Present value of coupon bond. Corporate Bond Valuation - Overview, How To Value And ... $1,000 face value 5% coupon rate ($50 coupon payments paid annually) 60 payout ratio ($600 default payout) 10 probability of default 5% risk-adjusted discount rate The first step in valuing the bond is to find the expected value at each period. It is done by adding the product of the default payout and the probability of default Coupon Bond - Guide, Examples, How Coupon Bonds Work Upon the issuance of the bond, a coupon rate on the bond’s face value is specified. The issuer of the bond agrees to make annual or semi-annual interest paymentsInterest PayableInterest Payable is a liability account shown on a company’s balance sheet that represents the amount of interest expense that has accruedequal to the coupon rate to investo... Calculation of the Value of Bonds (With Formula) Find present value of the bond when par value or face value is Rs. 100, coupon rate is 15%, current market price is Rs. 90/-. The bond has a six year maturity value and has a premium of 10%. If the required rate of returns is 17% the value of the bond will be: = Rs 15 (PVAF 17%6 Years )+110 (PVDF 17% 6 years ), = Rs. 15 x (3.589) +110 (.390) Bond Valuation Definition - Investopedia Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36 Present value of face value = 1000 / (1.015) 4 = 942.18 Therefore, the value of the...

Zero Coupon Bond Value Calculator: Calculate Price, Yield ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation. The following table shows how interest rates & term ... Valuing Bonds | Boundless Finance The present value of coupon payments is the present value of an annuity of coupon payments. An annuity is a series of payments made at fixed intervals of time. The present value of an annuity is the value of a stream of payments, discounted by the interest rate to account for the payments being made at various moments in the future. Solved What is the present value of a zero-coupon bond ... This problem has been solved! What is the present value of a zero-coupon bond with a par value of R 1 000 000, which is due to be redeemed in 10 years' time, when the market interest rate for such a bond is 6% p.a. Interest is compounded semi-annually? a. R553 676 b. R744 094 c. R742 470 d. Coupon Bond Formula | Examples with Excel Template The formula for coupon bond can be derived by using the following steps: Step 1:Firstly, figure out the par value of the bond being issued and it does not change over the course of its tenure. It is denoted by F. Step 2:Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment...

Solved The value of a bond is the present value of | Chegg.com The value of a bond is the present value of the: Select one: a. dividends and coupon payments. b. dividends and maturity value. c. maturity value. d. coupon payments and maturity value. Question: The value of a bond is the present value of the: Select one: a. dividends and coupon payments. b. Bond Present Value Calculator - buyupside.com The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments) Excel formula: Bond valuation example | Exceljet The arguments provided to PV are as follows: rate - C6/C8 = 8%/2 = 4% nper - C7*C8 = 3*2 = 6 pmt - C5/C8*C4 = 7%/2*1000 = 35 fv - 1000 The PV function returns -973.79. To get positive dollars, we use a negative sign before the PV function to get final result of $973.79 Between coupon payment dates Bond Valuation - Present Value of a Bond, Par Value ... The Present Value of a Bond = The Present Value of the Coupon Payments ( an annuity) + The Present Value of the Par Value ( time value of money) Example Par Value = $ 1,000 Maturity Date is in 5 years Annual Coupon Payments of $100, which is 10% Market Interest rate of 8% The Present Value of the Coupon Payments ( an annuity) = $399.27

Bond Present Value Calculator - UltimateCalculators.com Present Value of a Bond Definition Present Value of a Bond is the value of a bond equal to the discounted remaining interest payments and the discounted redemption value of the bond certificate. Variables PV of Bond=Current market value of bond Redemption Value=Value of bond when redeemed at maturity K=Current rate of return offered in the market

Calculating the Present Value of a 9% Bond in an 8% Market The present value of a bond's maturity amount. The present value of the bond in our example is $36,500 + $67,600 = $104,100. The bond's total present value of $104,100 should approximate the bond's market value.

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

How to Calculate PV of a Different Bond Type With Excel The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate...

The Time Decay of Bond Premium and Discount—An Analysis of the Time Passage Effect on Bond Prices

Coupon Bond Formula | How to Calculate the Price of Coupon ... Therefore, calculation of the Coupon Bond will be as follows, So it will be – = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers.

How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price or value is the present value of all future cash flows expected from the bond. As the bond has no interest payments, the only cash flow is the face value of the bond received at the maturity date. Zero Coupon Bond Pricing Example. Suppose for example, the business issued 3 year, zero coupon bonds with a face value of ...

How to Calculate the Present Value of a Bond | Pocketsense Present value is a technique to figure how much all the bond's cash flows -- return of face value plus coupon payments -- would be worth if they were all paid today, a process called discounting. Investors calculate the present value of a bond and use it as the price they'd be willing to fork over to buy or sell the bond. Concept of Discounting

Bond Price Calculator - Present Value of Future Cashflows ... The Present Value Formula 'PV' is, of course, the present value formula. Present value is the concept we hinted to above - the value of a stream of future payments discounted by the conditions in the market today. Present value, then, is a summation.

Post a Comment for "38 present value of coupon bond"