38 difference between coupon rate and market rate

Difference Between Yield & Coupon Rate 2.Yield rate is the interest earned by the buyer on the bond purchased, and is expressed as a percentage of the total investment. Coupon rate is the amount of interest derived every year, expressed as a percentage of the bond's face value. 3.Yield rate and coupon rate are directly correlated. The higher the rate of coupon bonds, the higher ... Solved The difference between the stated or coupon interest | Chegg.com Answer = C ( Changes monthly ) Stated or coupon rate of the bond is made by the bond issuer. Coupo …. View the full answer. Transcribed image text: The difference between the stated or coupon interest rate of a bond and the market interest rate for similar investments: A.

Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements.

Difference between coupon rate and market rate

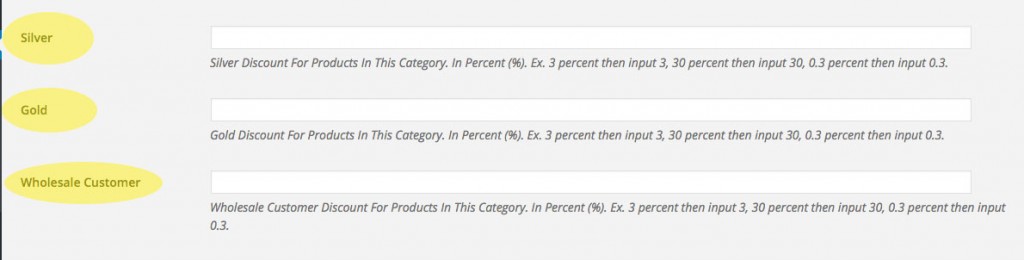

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%. Bonds - Coupon and Market Rates Differ - YouTube Lesson discussing how the value of a bond changes when coupon rates and market rates differ. Looks at why a bond will trade at a premium, discount, or at pa... Coupon vs Yield | Top 8 Useful Differences (with Infographics) While calculating the current yield, the coupon rate compares to the current market price of the bond. During the tenure of the bond, the bond price remains the same till maturity due to the continuous fluctuation of the market price; it is better to buy a bond at the discount rate which offers handsome returns on the maturity at face value.

Difference between coupon rate and market rate. Difference Between Coupon Rate and Interest Rate (With Table) The main difference between Coupon Rate and Interest Rate is that the coupon rate has a fixed rate throughout the life of the bond. Meanwhile, the interest rate changes its rate according to the bond yields. The coupon rate is the annual rate of the bond that has to be paid to the holder. What is the difference between the coupon rate and market rate? What is the difference between the coupon rate and market rate? No. of Words. 539. PRICE. $5.00. User Ratings. 0/5. 0 ratings. 0 ratings X. What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... What is 'Coupon Rate' Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. Duration vs. Maturity and Why the Difference Matters Sep 01, 2017 · See the diagram below to understand the relationship between the bond’s price and its interest rate (or coupon rate). A bond is quoted with its “coupon yield”. This refers to the annual interest payable as a percent of the original face or par value. An 8% bond with a par value of 1000 would receive $80 per year. Coupon/Interest Rate= 8%

Difference Between Coupon Rate and Interest Rate Coupon rate of a fixed term security such as bond is the amount of yield paid annually that expresses as a percentage of the par value of the bond. In contrast, interest rate is the percentage rate that is charged by the lender of money or any other asset that has a financial value from the borrower. Quick Answer: How Is Coupon Rate Determined - WhatisAny Understanding Coupon Rates A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. Difference Between Dell P Series and Dell S Series (With Table) Jul 03, 2020 · S series are for gamers. After thousands of products, Dell has an S series of computers that are low-end gaming monitors. Platinum silver color makes a breezy look to the monitor and gives a minimalist look. Difference Between Coupon Rate and Discount Rate (With Table) The coupon rate is determined by the presumptive worth of the security, which is being contributed. The Discount rate is determined by thinking about the hazard of loaning the sum to the borrower. The guarantor of the securities chooses the coupon rate for the buyer. The moneylender chooses the Discount more rated.

Solved What is the difference between a bond's coupon rate | Chegg.com We review their content and use your feedback to keep the quality high. 100% (2 ratings) A bond's coupon rate is the actual amount of interest income that the holder of a bond earns each year. The coupon rate …. View the full answer. Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond. The coupon rate... Yield to Maturity vs Coupon Rate: What's the Difference The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates. You need to know the coupon rate, the price of the bond, its value, and the maturity date to calculate the YTM. If you purchase the bond at face value, the YTM and the coupon rate are the ... Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... A bond is priced at a discount below par value when the coupon rate is less than the market discount rate. All else equal, the price of a lower-coupon bond is more volatile than the price of a higher-coupon bond. ... Concept 91: Difference in Forward and Futures Prices; Concept 92: Exercise Value, Time Value, and Moneyness of an Option ...

Finance exam 2 Flashcards | Quizlet It is also the expected return for an investor who buys the bond and holds it to maturity. The coupon rate determines the periodic interest payments made to investors. YTM is the expected return for an investor who buys the bond today and holds it to maturity. YTM is the prevailing market interest rate for bonds with similar features.

What is difference between coupon rate and interest rate? The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 basis points or 0.5%. That would push up all interest rates.

Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author.

Difference Between LED and QLED Jun 24, 2019 · Difference Between LED and QLED Television displays have been rapidly evolving since the inception of LCD technology in the late 1990s which almost kicked the CRT business out of the market. The world was only beginning to understand the LCD technology that LEDs surfaced which changed the course of history. First it was LCD, then LED, and now ...

Important Differences Between Coupon and Yield to Maturity Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

What Is a Fixed-Rate Bond? - Investopedia Mar 31, 2021 · Fixed-Rate Bond: A fixed-rate bond is a bond that pays the same amount of interest for its entire term. The benefit of owning a fixed-rate bond is that investors know with certainty how much ...

Bond Market vs. Stock Market: Key Differences - Investopedia Feb 22, 2021 · The other key difference between the stock and bond market is the risk involved in investing in each. When it comes to stocks, investors may be exposed to risks such as country or geopolitical ...

Coupon vs Yield | Top 5 Differences (with Infographics) On the basis of the coupon payment and face value of the bond, the coupon rate is calculated. The yield of the bond, on the other hand, is the interest rate on the basis of the current market price of the bond and is thus also known as the effective rate of return for a bond.

Post a Comment for "38 difference between coupon rate and market rate"