39 ytm zero coupon bond

Microsoft Excel Bond Yield Calculations | TVMCalcs.com We know that the bond carries a coupon rate of 8% per year, and the bond is selling for less than its face value. Therefore, we know that the YTM must be greater than 8% per year. You need to remember that the bond pays interest semiannually, and we entered Nper as the number of semiannual periods (6) and Pmt as the semiannual payment amount ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an excellent ...

Current Yield vs. Yield to Maturity - Investopedia Dec 13, 2021 · For example, a bond with a $1,000 par value and a 7% coupon rate pays $70 in interest annually. Current Yield of Bonds The current yield of a bond is calculated by dividing the annual coupon ...

Ytm zero coupon bond

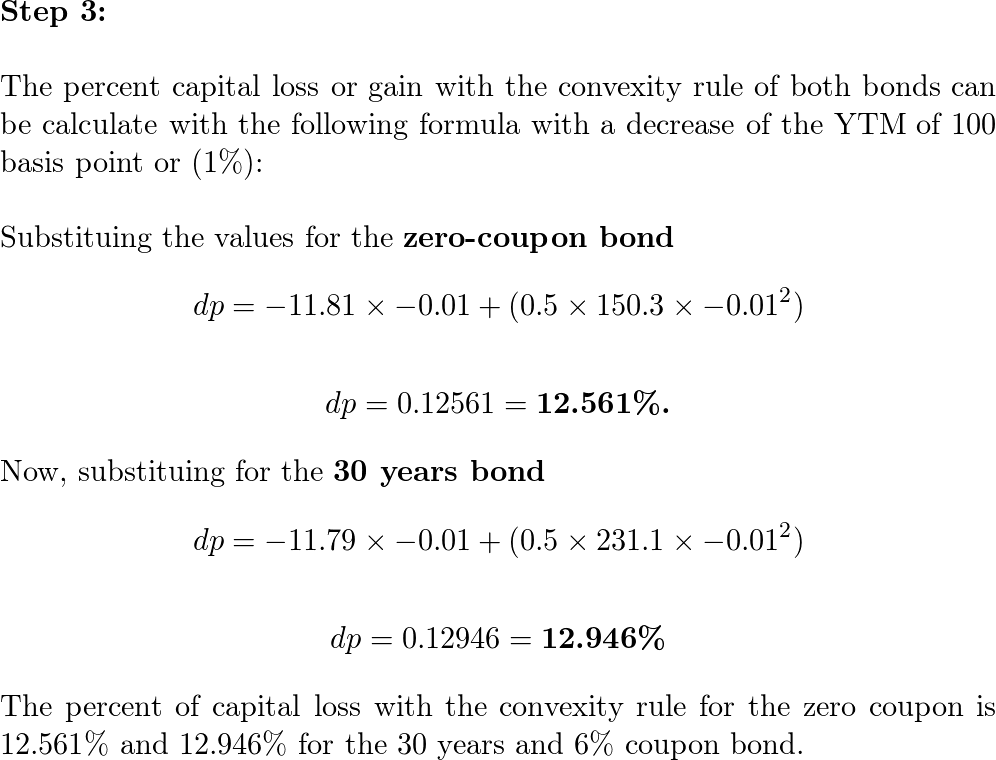

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: Bond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. The prevailing ...

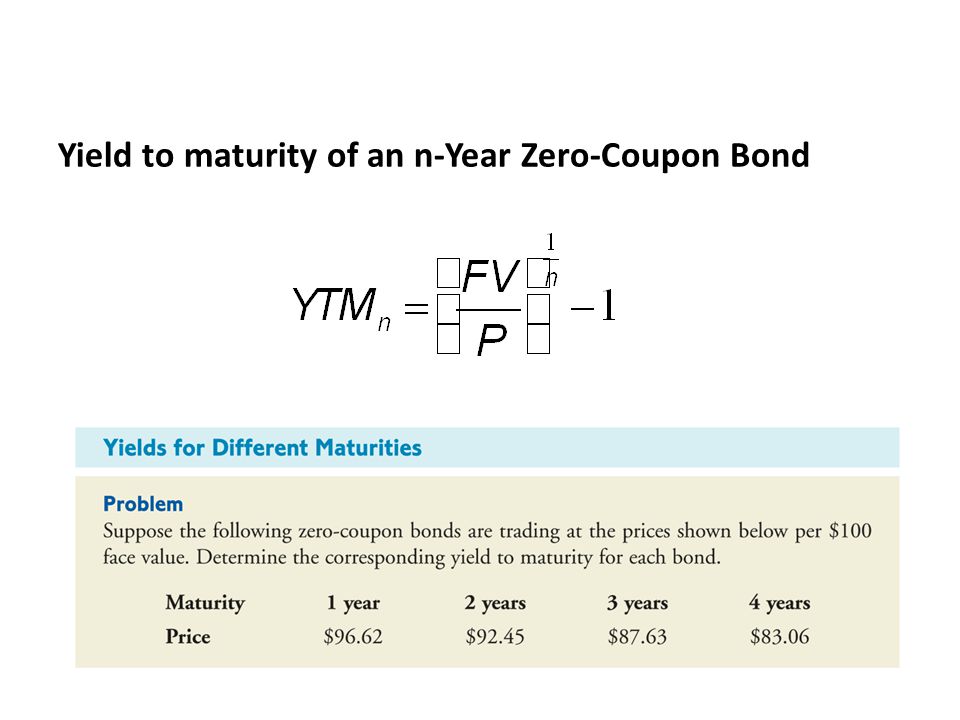

Ytm zero coupon bond. Yield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... What is a Zero Coupon Bond? Who Should Invest? | Scripbox For example, if the bond's face value is Rs.100, and it pays an interest of 8%. Here, the interest rate is the bond coupon. What is yield to maturity for a zero coupon bond? Yield is a measure of all the cash flows of an investment over a period of time. It considers all the coupon payments and dividends received during the term of an investment. How to Calculate Yield to Maturity of a Zero-Coupon Bond Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula... Zero-Coupon Bond: Formula and Calculator [Excel Template] To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators. Zero coupon bonds are yet another interesting security in the fixed income world. Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. This makes typical bonds a great source of income, though … ytmZeroCouponBond: Calculates the Yield-To-Maturity(YTM) of a Zero ... The method ytmZeroCouponBond () is developed to compute the Yield-To-Maturity a Zero-Coupon Bond. So, ytmZeroCouponBond () gives the Price of a Zero-Coupon Bond for values passed to its three arguments. Here, maturityVal represents the Maturity Value of the Bond, n is number of years till maturity, and price is Market Price of Zero-Coupon Bond.

Current yield - Wikipedia When a coupon-bearing bond sells at; a discount: YTM > current yield > coupon yield; a premium: coupon yield > current yield > YTM; par: YTM = current yield = coupon yield. For zero-coupon bonds selling at a discount, the coupon yield and current yield are zero, and the YTM is positive. See also. Adjusted current yield; References. Current Yield at investopedia.com; This page was … Zero Coupon Bond Yield Calculator - YTM of a discount bond - Vin Zero Coupon Bond Yield Calculator. A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond. Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: Bond Yield to Maturity (YTM) Calculator - DQYDJ You can compare YTM between various debt issues to see which ones would perform best. Note the caveat that YTM though – these calculations assume no missed or delayed payments and reinvesting at the same rate upon coupon payments. For other calculators in our financial basics series, please see: Zero Coupon Bond Calculator

Zero-Coupon Bond - Definition, How It Works, Formula What is a Zero-Coupon Bond? A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest.

write down the formula that is used to calculate the yield to maturity on a twenty year 12 coupon bo

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Yield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds

Zero Coupon Bonds - Financial Edge What is the present value of a zero coupon bond with a face value of 1000 maturing in 5 years? The current interest rate is 3%. Using the formula mentioned above gives 862.6 as the bond's present value. Calculating yield-to-maturity or expected returns. Yield to maturity (YTM) is the expected return on a bond if it is held until maturity.

CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL - YouTube In this lecture I am explaining how to #TYM#YieldToMaturity#HOW_TO_CALCULATE_YIELD_ON_ZERO_COUPON_BOND #YTM_IN_EXCEL calculate the yield on zero COUPON bond ...

Bond Formula | How to Calculate a Bond | Examples with Excel … On the other hand, the formula for zero-coupon bond (putting C = 0 in the above formula) is represented as, ... Step 4: Next, determine the YTM of the bond on the basis of the return currently expected from securities with similar risk profiles. The YTM is denoted by r. Step 5: Next, determine the number of coupon payments to be paid during a year, which is denoted by n. To …

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000.

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. The prevailing ...

Bond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below:

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

![PDF] Zero Coupon Yield Curve Estimation with the Package ...](https://d3i71xaburhd42.cloudfront.net/099642ebfde435cc2d7b668516eea73c11bbd53b/13-Figure2-1.png)

Post a Comment for "39 ytm zero coupon bond"