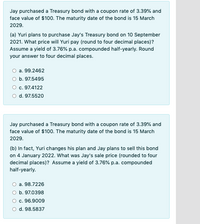

42 treasury bonds coupon rate

Home [ ] The Fixed Rate Retail Savings Bond series consists of bonds with 2-year, 3-year and 5-year terms. Fixed Rate Retail Savings Bonds earn a market-related fixed interest rate, which is priced off the current government bond yield curve, and is payable on the interest payment dates until maturity. Front page | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. ... Savings Bonds - Treasury Securities. ... Treasury Interest Rate Statistics .

Who sets the coupon rate for treasury bonds? : r/bonds - reddit The Federal Reserve sets the coupon rate as the fiscal agent for the Treasury. But there's really no "setting." Whatever is the winning yield at auction, they raise it to the next highest 8th and that becomes the coupon. So if the winning yield is 2.10, the coupon would become 2.125. 2.

Treasury bonds coupon rate

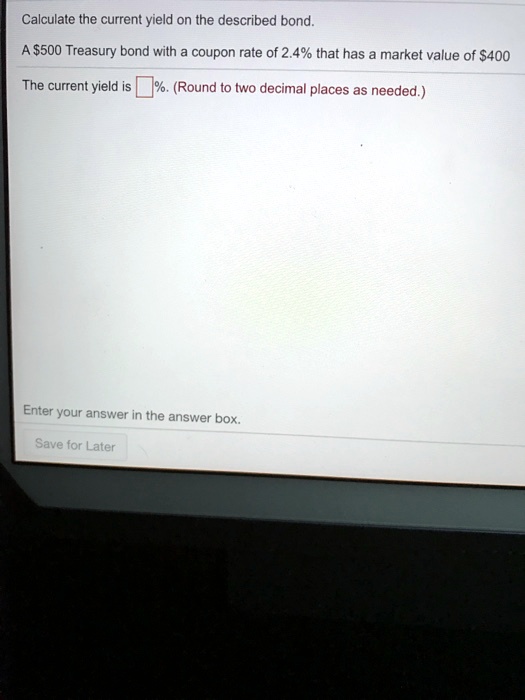

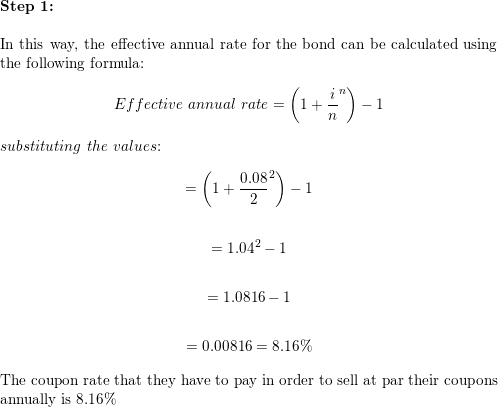

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by ... Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. United States Treasury security - Wikipedia Treasury Inflation-Protected Securities (TIPS) are inflation-indexed bonds issued by the U.S. Treasury. Introduced in 1997, they are currently offered in 5-year, 10-year and 30-year maturities. The coupon rate is fixed at the time of issuance, but the principal is adjusted periodically based on changes in the Consumer Price Index (CPI), the ...

Treasury bonds coupon rate. I bonds — TreasuryDirect Compare I savings bonds to TIPS (Treasury's marketable inflation-protected security) Current Interest Rate. Series I Savings Bonds. 6.89%. For savings bonds issued November 1, 2022 to April 30, 2023. ... We list interest rates for all I bonds ever issued in 2 ways: Matrix showing fixed rates, inflation rates, and combined rates together (PDF) Treasury Bonds: A Good Investment for Retirement? - Investopedia May 25, 2022 · Treasury notes or T-notes are very similar to Treasury bonds in that they pay a fixed rate of interest every six months until their maturity. However, Treasury notes have shorter maturity dates ... newbie question on treasury bills : r/bonds I remember from a class that the coupon rate is the interest income the bond buyer gets. But the Treasury website lists interests which are higher than the coupon rates I'm seeing. For example, I see: US Treas Bill zero coupon, maturity date 12/29/22 Bid yield 3.882 Ask yield to worst 3.858, yield to maturity 3.858 Treasury Bonds — TreasuryDirect Interest rate: The rate is fixed at auction. It does not vary over the life of the bond. It is never less than 0.125%. See Interest rates of recent bond auctions. Interest paid: Every six months until maturity: Minimum purchase: $100: In increments of: $100: Maximum purchase: $10 million (non-competitive bid) 35% of offering amount (competitive ...

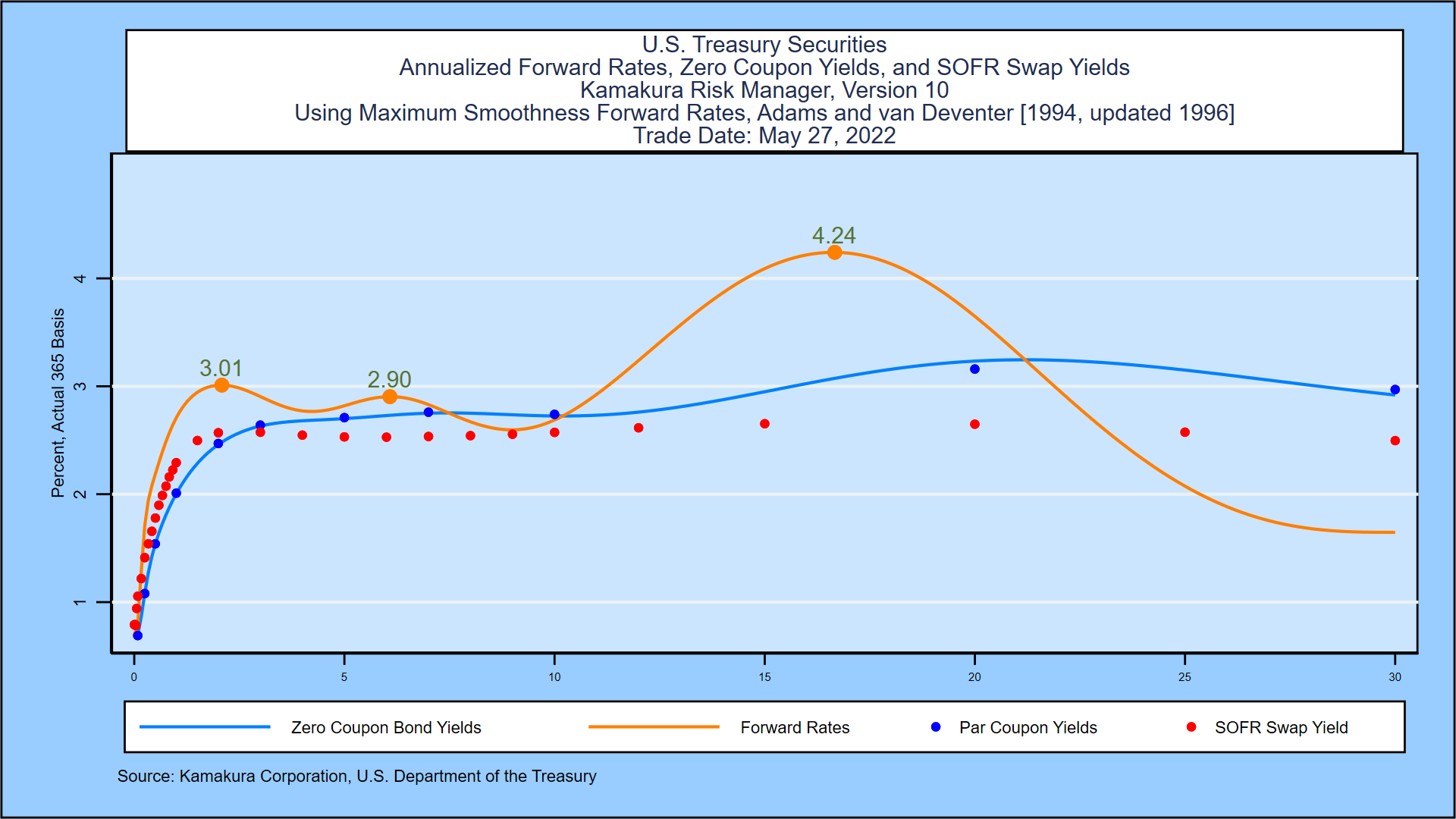

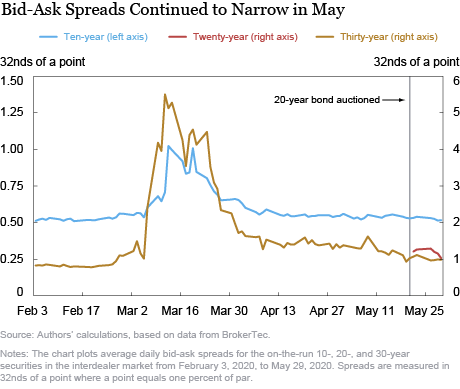

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Treasury Coupon Issues | U.S. Department of the Treasury The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS). ... TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977 TNC Treasury Yield Curve Spot ... Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The ... Understanding Pricing and Interest Rates — TreasuryDirect The interest rate of an FRN changes, or "floats," over the life of the FRN. The interest rate is the sum of two parts: an index rate and a spread. Index rate - The index rate of your FRN is tied to the highest accepted discount rate of the most recent 13-week Treasury bill. We auction the 13-week bill every week, so the index rate of an FRN ...

Treasury Bond (T-Bond) - Overview, Mechanics, Example A Treasury bond (or T-Bond) is a long-term government debt security issued by the U.S. Treasury Department with a fixed rate of return. Maturity periods range from 20 to 30 years. T-bond holders receive semi-annual interest payments (called coupons) from inception until maturity, at which point the face value of the bond is also repaid. Treasury Coupons - Macro Economic Trends and Risks - Motley Fool Community Leap1 November 10, 2022, 5:50pm #3. Mark, I found it on the treasury website. It is under the TNC, treasury nominal coupon rate, in table form. Thanks anyway. WendyBG November 10, 2022, 10:32pm #4. The Federal Reserve has data and charts which I use all the time. Google "FRED 10 year Treasury" or any other maturity. Treasury Notes — TreasuryDirect Maximum purchase. $10 million (non-competitive bid) 35% of offering amount (competitive bid) (See Buying a Treasury marketable security for information on types of bids.) Auction frequency. 2, 3, 5, and 7-year notes: Monthly. 10-year notes: Feb., May, Aug., Nov. Reopenings of 10-year notes: 8 times/year. See the Auction calendar for specific dates. I bonds interest rates — TreasuryDirect Current Interest Rate. Series I Savings Bonds. 6.89%. For savings bonds issued November 1, 2022 to April 30, 2023. Fixed rate. You know the fixed rate of interest that you will get for your bond when you buy the bond. The fixed rate never changes. We announce the fixed rate every May 1 and November 1.

Treasury Bonds | CBK Treasury Bond Results. AUGUST 2022 FXD1-2022-003, FXD2-2019-010 AND FXD1-2021-20 DATED 22-AUG 2022.. Please note that calculators are provided to serve as guides for investors, but all final pricing is determined by the Central Bank. This calculator allows you determine what your payment would be based on the bond's face value, coupon rate ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Risks of Zero-Coupon U.S. Treasury Bonds. Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall ...

US Treasury Bonds - Fidelity Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills ...

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Treasury Yields. Name Coupon Price Yield 1 Month 1 Year Time (EST) GB3:GOV . 3 Month .

How To Buy Treasury Bonds And Buying Strategies To Consider Sep 28, 2022 · Step 2: You will see a chart that shows all types of bonds based on duration. I’ve highlighted the U.S. Treasury row in a red box. In the image, the U.S. Treasury yields range from 4.15% for a 3-month treasury bill (was 3.5% in September 2022) to 4.15% on a 30-year Treasury bond.

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Coupon Rate Definition - Investopedia Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

United States Treasury security - Wikipedia Treasury Inflation-Protected Securities (TIPS) are inflation-indexed bonds issued by the U.S. Treasury. Introduced in 1997, they are currently offered in 5-year, 10-year and 30-year maturities. The coupon rate is fixed at the time of issuance, but the principal is adjusted periodically based on changes in the Consumer Price Index (CPI), the ...

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by ...

:max_bytes(150000):strip_icc()/10-year-treasury-note-3305795-Final-b5449ca2619747788f6366ccebd81ca7.png)

:max_bytes(150000):strip_icc()/GettyImages-172745598-5756f5bd3df78c9b46977f64.jpg)

Post a Comment for "42 treasury bonds coupon rate"