44 coupon rate and yield to maturity

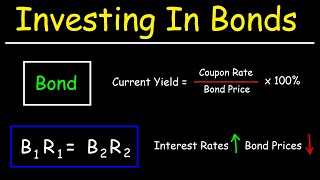

Bond's Price, Coupon Rate, Maturity | CFA Level 1 - AnalystPrep Relationships Among a Bond's Price, Coupon Rate, Maturity, and Market Discount Rate. 27 Sep 2019. Price versus Market Discount Rate (Yield-to-maturity) The price of a fixed-rate bond will fluctuate whenever the market discount rate changes. This relationship could be summarized as follows: › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Yield to Maturity Questions and Answers | Homework.Study.com You are looking at investing in an annual coupon bond with 8 years to maturity, a face value of $1000, a yield to maturity of 8.5 %, and a price of $1098.61. What is the annual coupon of the bond?...

Coupon rate and yield to maturity

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3

Coupon rate and yield to maturity. calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ... Solved Suppose a ten-year, bond with an coupon rate and - Chegg 83% (6 ratings) Transcribed image text: Homework: Assignment 6 (Chapter 6) Score: 0 of 1 pt 1 8 of 10 (6 complete) P 6-12 (similar to) Suppose a ten-year $1,000 bond with an 8.3% coupon rate and semiannual coupons is trading for $1,034.89. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia To understand the full measure of a rate of return on a bond, check its yield to maturity. Yield Rate A bond's yield can be measured in a few different ways. The current yield compares the coupon... Yield to Maturity Calculator This yield to maturity calculator approximates a bond's yield to maturity by considering its annual coupon payment, its face value & current clean price and the no. of years. ... In case a bond's coupon rate < YTM, THEN the bond is selling at a discount. Example of a calculation. Let's assume a bond with the following characteristics:

Coupon Rate: Formula and Bond Yield Calculator - Wall Street Prep Coupon Rate (%) = $50,000 / $1,000,000 Coupon Rate (%) = 5% Therefore, the bond is priced at a coupon rate of 5% on a $1 million par value, resulting in two semi-annual payments of $25,000 per year until the bond reaches maturity. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. What Is the Difference Between Coupon Rate and Yield-To-Maturity ... Coupon rate is expressed as the percentage (per annum basis) of the face value of the bond. It is the amount that the bondholders will receive for holding the bond. Coupon payments are usually made semi-annually or quarterly. Yield-to-maturity (YTM), as the name states, is the rate of return that the investor/bondholder will receive, assuming ... How to Calculate the Price of Coupon Bond? - WallStreetMojo Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Therefore, the price of each bond can be calculated using the below formula as,

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually. Assuming you hold the bond to maturity, you will receive 12 coupon payments of $125 each, or a total of $1,500. Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Using the YTM formula, the required yield to maturity can be determined. INR 950 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 40/ (1+YTM)^3+ 1000/ (1+YTM)^3 We can try out the interest rate of 5% and 6%. The bond prices for these interest rates are INR 972.76 and INR 946.53, respectively. Since the current price of the bond is INR 950. dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ On this page is a bond yield to maturity calculator, to automatically calculate the internal rate of return (IRR) earned on a certain bond. This calculator automatically assumes an investor holds to maturity, reinvests coupons, and all payments and coupons will be paid on time. › finance › yield-to-maturityYield to Maturity Calculator | Calculate YTM Jul 14, 2022 · Determine the annual coupon rate and the coupon frequency; coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a ...

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

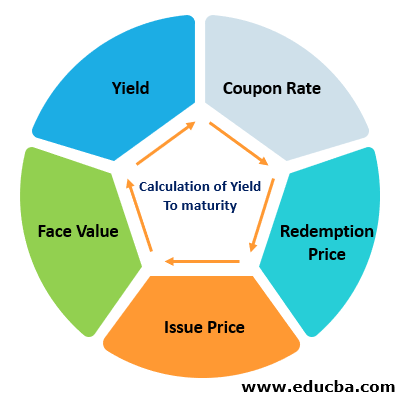

Difference Between Yield to Maturity and Coupon Rate The coupon rate is 5.25% with a term to maturity of 4.5 years. Yield to Maturity is calculated as, Yield to Maturity = 5.25 + (100-102.50/4.5) / (100+102.50/2) = 4.63% Yield to Maturity can be identified as an important yardstick for an investor to understand the amount of return a bond will generate at the end of the maturity period.

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value.

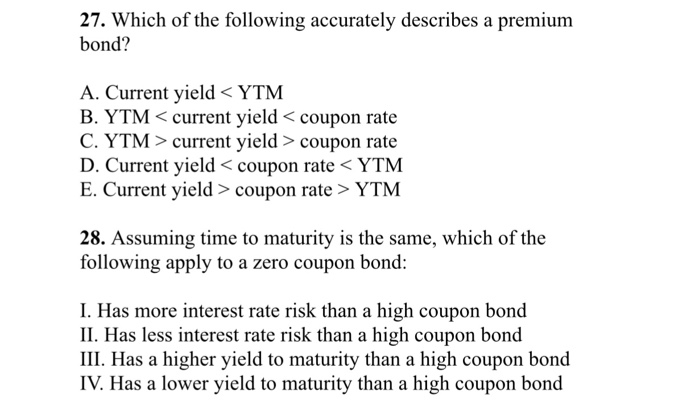

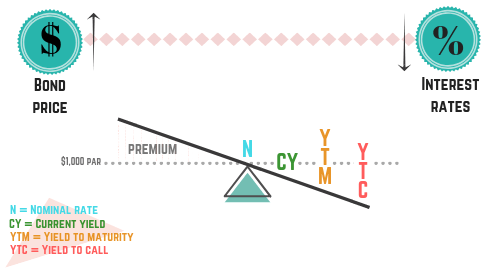

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate. A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. A bond is priced at a discount below par value when the coupon rate is less than the market discount rate.

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Bond's Maturity, Coupon, and Yield Level - AnalystPrep Longer maturity bond prices are more sensitive to changes in yields than shorter maturity bonds. As shown in the following graph, the price of the 30-year bond increases a lot more than that of the 1-year bond in response to a decrease in interest rates. Coupon Rate. Bonds with higher coupon rates are less sensitive to changes in interest rates.

Yield to Maturity Calculator | Good Calculators r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to Maturity?

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than...

› Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate. Since we know that the coupon rate is 5 percent, we can start by plugging numbers that are higher than that into the formula above to solve for P. [6] X Research source

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

PDF Yield-to-Maturity and the Reinvestment of Coupon Payments that in order to earn the yield to maturity on a coupon bond an investor must reinvest the coupon payments. We identify a ... She goes on to specify that the "coupons are reinvested at an interest rate equal to the yield-to-maturity." (Thau 2002, p. 25).

› how-to-calculate-yield-toHow to calculate yield to maturity in Excel (Free ... - ExcelDemy Sep 14, 2022 · How to Calculate Yield to Maturity (YTM) in Excel 1) Using the RATE Function. Suppose, you got an offer to invest in a bond. Here are the details of the bond: Par Value of Bond (Face Value, fv): $1000; Coupon Rate (Annual): 6%; Coupons Per Year (nper): 2. The company pays interest two times a year (semi-annually). Years to Maturity: 5 years.

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Yield to maturity is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40. And the price of the bond is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = 5-Year Treasury Yield + .05% So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5-Year Treasury Yield is 6.5%, then the revised coupon rate will be 7%.

Difference between Coupon Rate And Yield To Maturity - Savart The yield to maturity of a bond is equivalent to the rate of interest which makes the present value of the future cash flows of the bond equal to its prevailing price. These cash flows are inclusive of all interest payments and its value at maturity. For instance, a bond having a face value of Rs. 1000/-, having 5-years to maturity and paying ...

Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "44 coupon rate and yield to maturity"